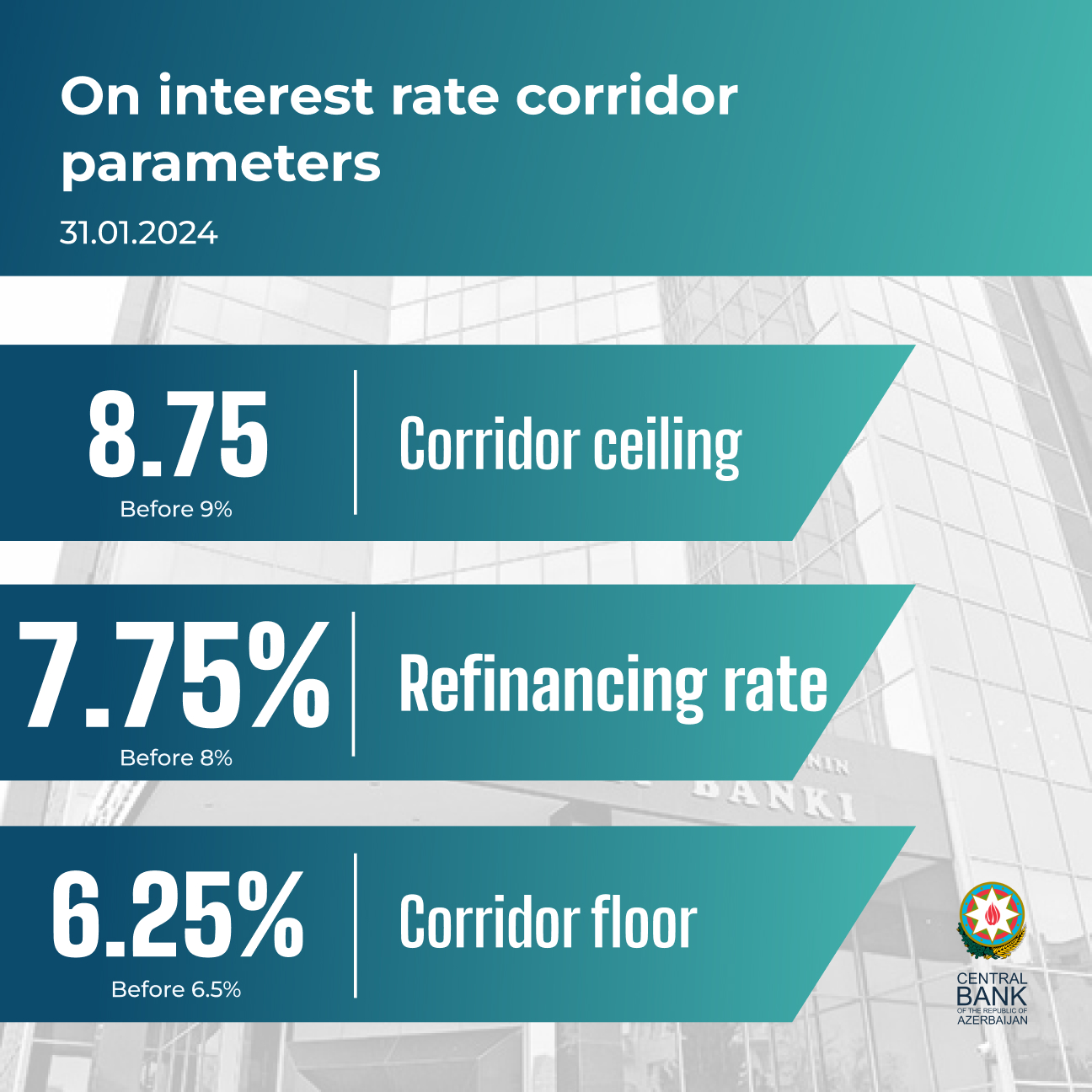

31 January 2024, Baku: The Management Board of the Central Bank of the Republic of Azerbaijan decided to decrease the refinancing rate to 7.75% from 8%, the floor of the interest rate corridor to 6.25% from 6.5% and the ceiling of the interest rate corridor to 8.75% from 9%.

This decision was made, considering that both the actual and projected inflation is within the target band (4±2%), inflation expectations stabilized, and the situation in the FX market is favorable.

The annual inflation rate has dropped since the last meeting of the Management Board dedicated to the monetary policy. In 2023 annual inflation stood at 2.1%, in the lower bound of the target band (4±2%). Inflation fell across all group components of the consumer basket. Annual food inflation stood at 0.8%, non-food inflation at 2.7%, and services inflation at 3.7%. The dynamics of actual inflation weighed on inflation expectations too.

According to recent surveys, the share of households expecting higher inflation decreased to 69% in Q4 from 81% in Q3 2023.

Annual inflation decreased due to the influence of both external and internal factors. Slowed global economic activity, as well as persistent fall of prices for global commodity, energy and food prices contained inflation import. According to the World Bank, the commodity price index fell by 18.9% in December on an annual basis, including energy prices decreased by 24%. The UN FAO reported 10.1% drop in the food price index in December on an annual basis.

The FX market equilibrium played a crucial role in containing inflation import. In 2023 supply prevailed over demand at 92% of currency auctions held at the Central Bank. Over the year the nominal effective exchange rate of the manat appreciated by 19.3%, the factor that has a downward effect on imported inflation.

As expected, the main event affecting the monetary condition since the last meeting has been the implementation of large-scale currency purchases for the fiscal sector. In general, purchase-oriented foreign exchange interventions of the Central Bank to the FX market amounted to $2.1B in 2023.

Currency purchases facilitated the increase in banking system liquidity. In total money base in manat increased by 19.6% in 2023 (out of which 14.6 pp in December). Monetary policy tools were used to neutralize the impact of autonomous factors outside of monetary policy on monetary conditions and strengthen interest rate transmission. Standing facilities and open market operations allowed weighted average interest rates of both unsecured and secured transactions between banks in the national currency in the money market move in the same direction with the interest rate corridor of the Central Bank. Thus, over the past period of January, the average interest rate on one-day unsecured transactions (1D AZIR) was 6.74% (7.4% in December) and a one-week interbank Repo rate (1W AINAIB) was 6.84% (7.8% in December), within the interest rate corridor.

There are risks that may impact inflation, albeit the said positive trends. Lingering geopolitical tensions may lead to a resurgence in the prices of various commodities in the world market. The recent Red Sea crisis has a serious impact on the global supply chain. International organizations keep energy price forecasts high for 2024. Climate changes also continue weighing on food prices. However, a slow global economic activity and persistently tight monetary condition in most economies may have a downward pressure on global inflation.

The main domestic risks that may push inflation are the overexpansion of aggregate demand and the activation of domestic cost factors. If current trends linger, the Central Bank may make a purchase-oriented intervention to the FX market in 2024 as over recent two years. The Central Bank always monitors the dynamics of budget expenditures and lending activity as domestic demand factors.

In general, upside and downside risks of inflation balance each other. The inflation forecast for 2024 was left unchanged. As in last October according to January 2024 forecasts, annual inflation is expected to remain within the target band in 2024.

Interest rate corridor parameters related next decisions will depend on the variation of external and internal inflation factors. When decisions are made, the Bank will consider the characteristics of monetary policy transmission in the country, and processes in financial markets, including the FX market. In case the above risks do not materialize, the possibility of stepwise monetary policy easing will be considered over the remaining part of the year.

This decision takes effect on 1 February 2024. The information on the next decision on interest rate corridor parameters will be made public on 28 March 2024.

31.01.2024

966

966